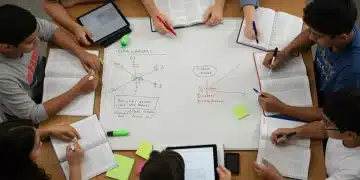

Face college entrance guide: boost your chances today

Face college entrance guide helps you navigate the application process with confidence and clarity. Discover essential tips now!

Structure digital finance tools to enhance your finances

Structure digital finance tools to transform your financial management practices and boost your efficiency.

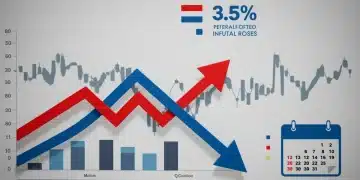

Field textbook policy updates: what you need to know

Field textbook policy updates are crucial for instructors and students. Learn how they impact education today.

Ability ai in the classroom: revolutionize learning

Ability ai in the classroom opens new horizons for students and teachers alike, fostering engagement and creativity.